The Chattanooga Real Estate Monday Market report for August 1st, 2022 will discuss real estate shift in Chattanooga. What is happening with the home prices? Are we expecting a real estate crash?

Find out all this information and more in this episode of the Monday Market Report.

YouTube Video – Real Estate Shift in Chattanooga

Podcast Episode – Real Estate Shift in Chattanooga

Real Estate Shift in Chattanooga

So the question is “Are there more houses coming on the market then the demand for homes?” Yes … the real estate market shift is real but will it lead to a crash? There are only 3 ways homes come to the market: resales of existing homes, new construction homes and distressed homes. Let’s look at each.

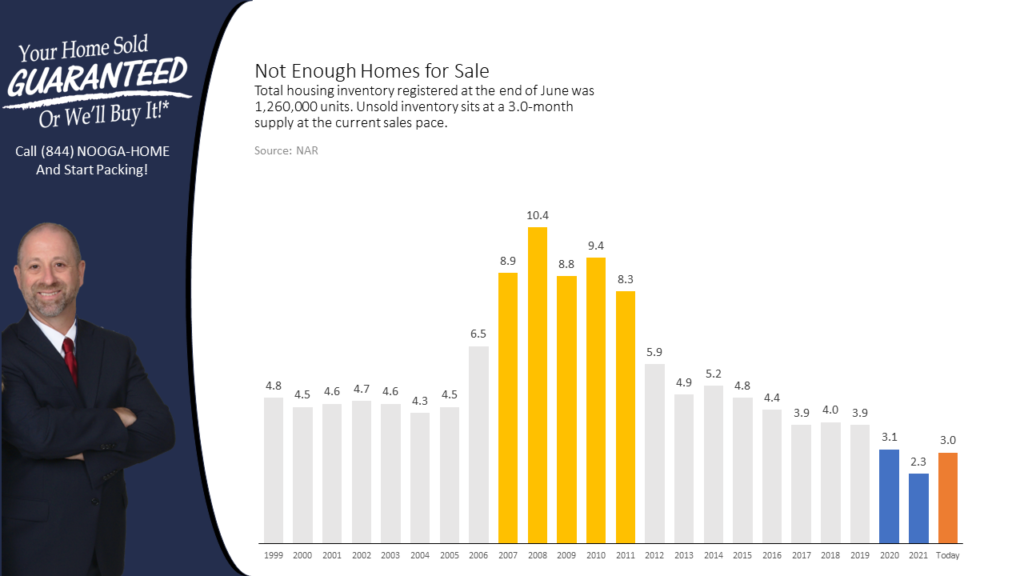

Not Enough Homes For Sale

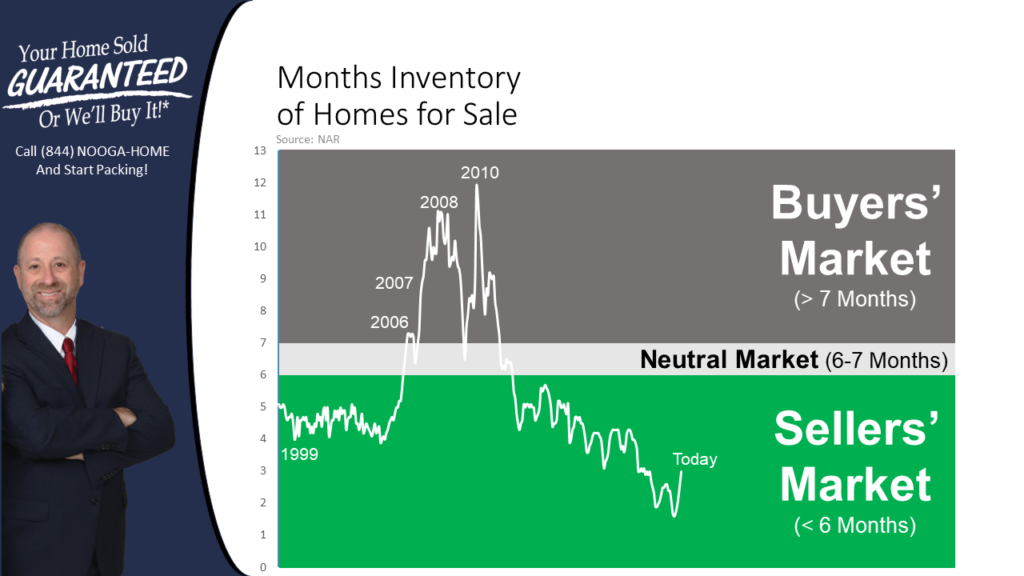

The inventory of homes on the market nationally is about 3 months worth. If we stopped listing homes for sale, in three months they would all be gone. We just aren’t seeing, nor expect regular sellers to flood the market with homes for sale. Even if a ton of people listed their homes for sale it would not be enough to give us a surplus.

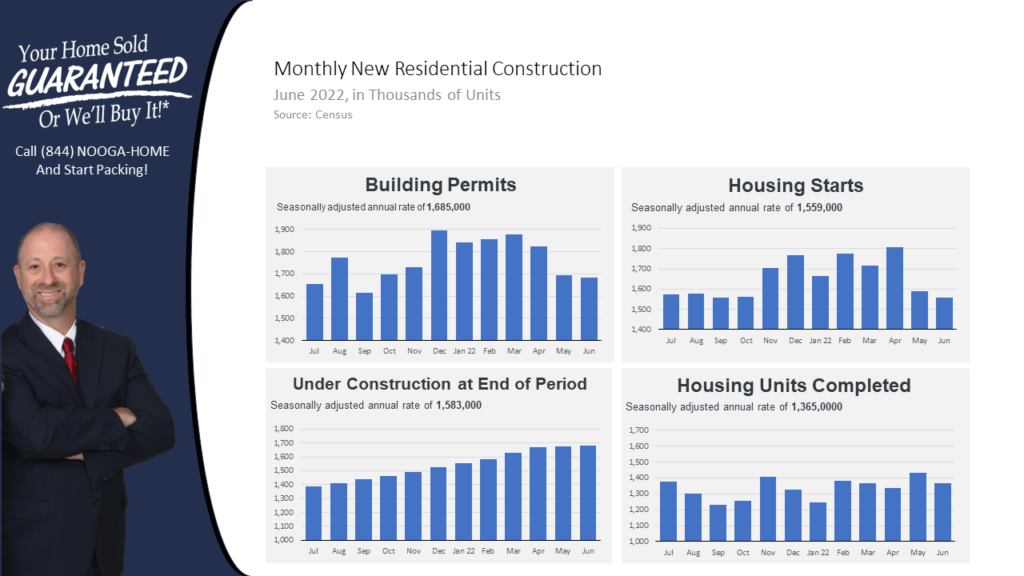

Builder Start Rates Slowing

Do to material shortages, labor shortages and building costs rising, builders have slowed the number of home starts and building permits they are applying for. Therefore, we are seeing less homes come to market through new construction and they are not going to flood us with inventory.

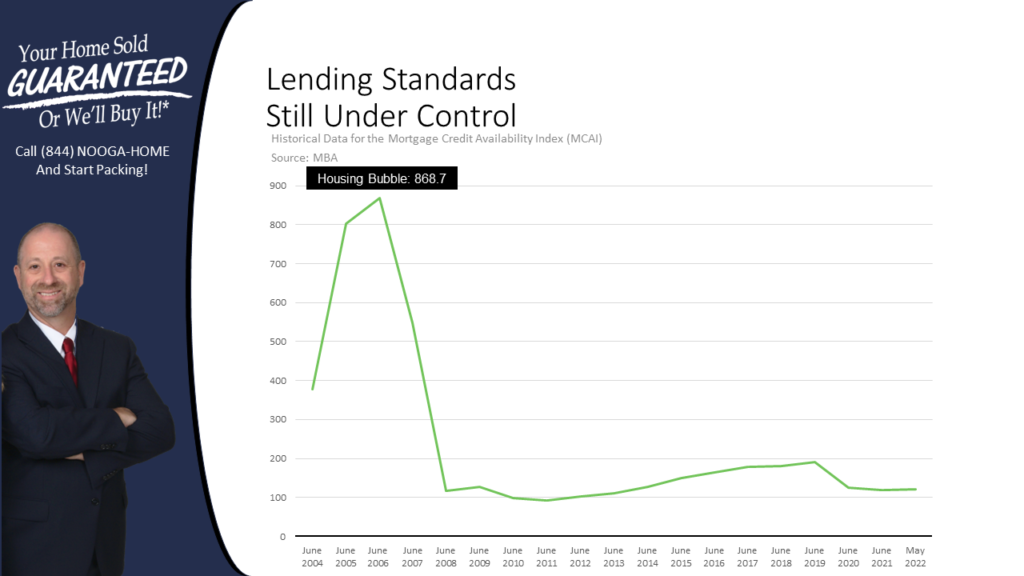

Lending Standards Are Still Tough

This only leaves distress homes to flood the market. Let’s look into that deeper. It is still difficult to get a loan and people that are getting qualified are normally very worthy buyers who are less likely to default. The mortgage credit availability index shows us that it still very difficult to get a loan unlike the 2006-2007 era when lending was free and easy.

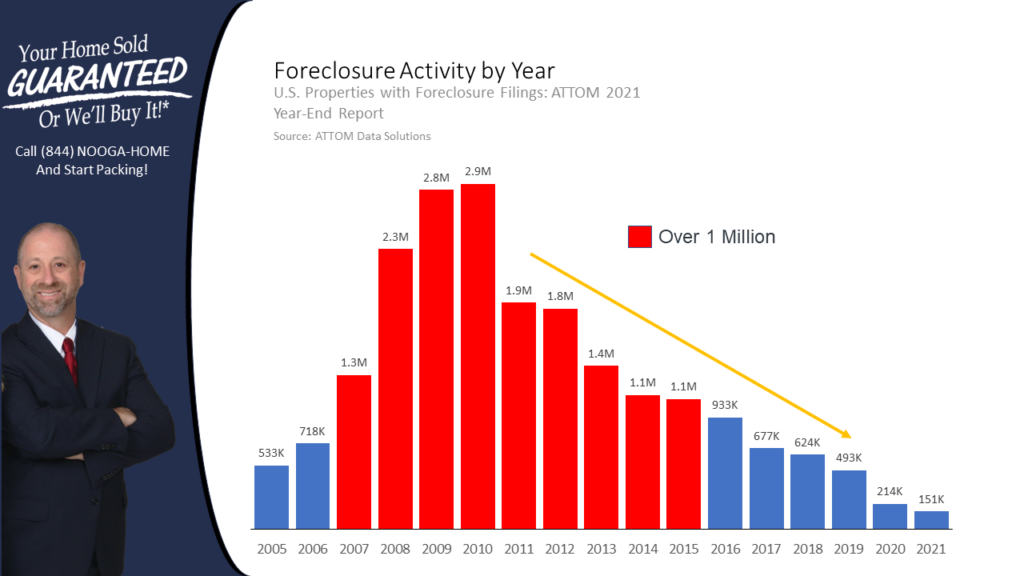

Therefore, the foreclosure activity has been less and less and it directly reflects the mortgage credit availability index seen above.

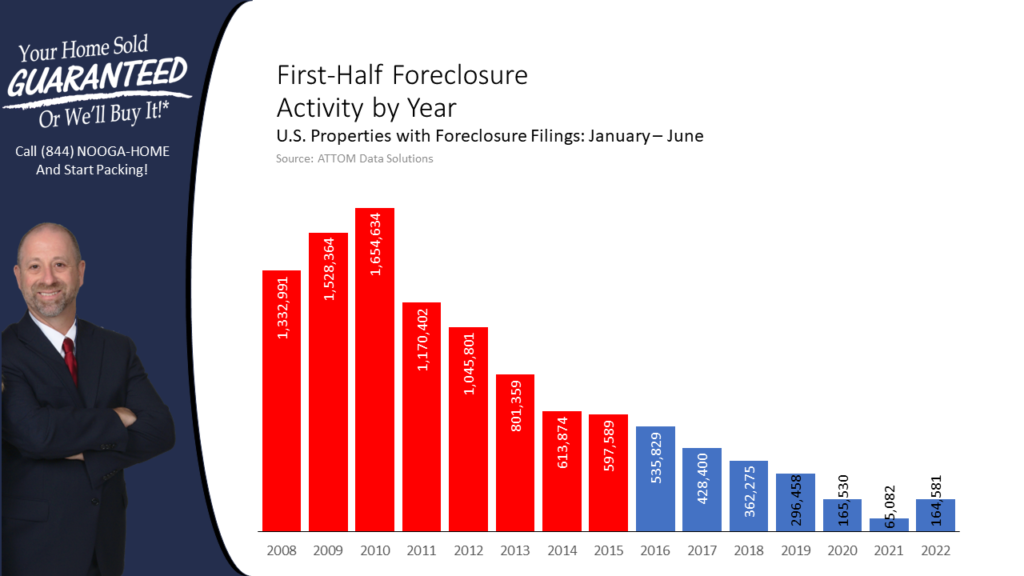

Even coming out of the Covid era and the forbearance period in 2022. You can see by the graph below that number of foreclosures has not shot up. We are actually returning to normal low numbers like 2019. The number of foreclosures will rise but they will not flood the market.

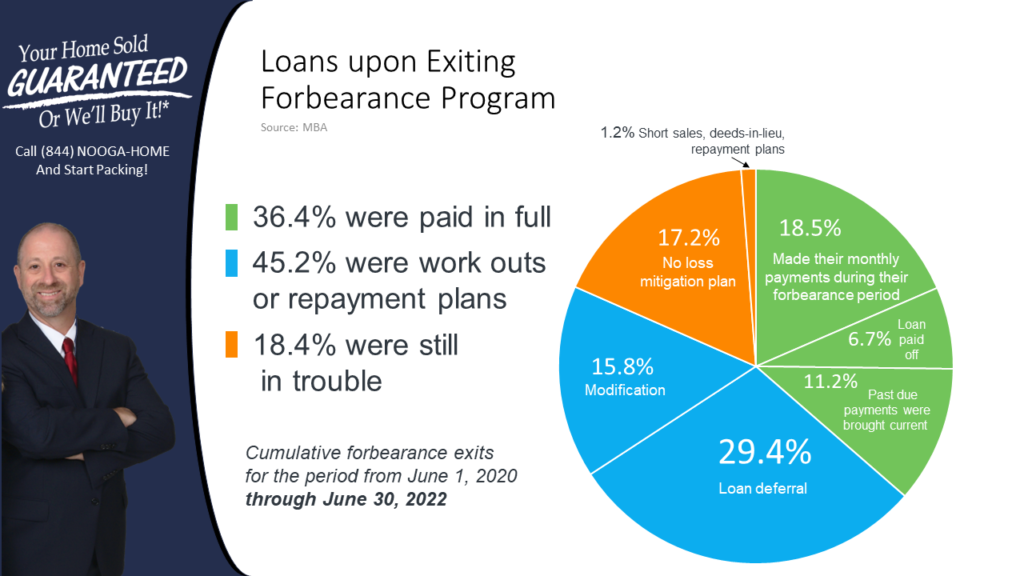

But why has coming out of the forbearance period not effected our in flow of new properties? We assumed that people would not be able to make up the payments during that period but from the chart below, we see differently.

The green blocks are paid in full loans where people took care of any payment problems and in some cases they even were able to pay off their loans completely! The blue areas show that those people were able to come up with a positive outcome of their mortgage by either deferring payments to the end of their term or refinancing their loan. Only the orange section shows loans still having issues. The orange section only makes up 18.4% of the loans. Even if all of them came to the market, it would not be enough inventory to overwhelm or market with homes.

It all boils down to the chart below. With the volume of inventory and the amount of purchases, we are remaining in a seller’s market. In a seller’s market, there is more demand than supply. When that happens, prices continue to rise. They will rise more slowly and normal pace, but still rising.

If you have any questions about the real estate market or you are thinking of buying or selling a home in the Chattanooga and North Georgia area, please feel free to reach out to us at the Nooga Team (423) 810-9474 and remember, with the Nooga Team, Your Home is Sold Guaranteed or We’ll Buy It!*